Last week, the U.S. Department of Justice, accompanied by 11 state attorneys general, sued Google under Section 2 of the Sherman Act, 15 U.S.C. § 2. The action seeks to “restrain [Google] from unlawfully maintaining monopolies in the markets for general search services, search advertising, and general search text advertising in the United States through anticompetitive and exclusionary practices, and to remedy the effects of this conduct.” While widely lauded as decisive action against the power of “Big Tech”, this complaint will usher in years of mind-numbingly expensive litigation led by the top law firms in the country, the success or failure of which will hinge on a battle of economists seeking to prove or disprove the complaint’s carefully chosen markets. Daubert motions will be as dispositive as any motion to dismiss or summary judgment. The court will come to its conclusion based on hundred-page economist expert reports, and after analyzing a dizzying array of graphs and regressions.

Many antitrust scholars decry the chokehold of the economists on contemporary antitrust jurisprudence, mostly blaming Chicago School economics and Robert Bork’s seminal 1978 book, The Antitrust Paradox. See e.g., Barak Orbach, How Antitrust Lost Its Goal, 81 Fordham L. Rev. 2253 (2013). These scholars see a break between prior antitrust enforcement focused on “trust busting,” and the subsequent adoption of a “consumer welfare test,” to be proven by economic analysis, as the center of U.S. antitrust law. Far from being a complete departure, however, this development was the natural result of liberalism’s unraveling of business regulation from the common good.

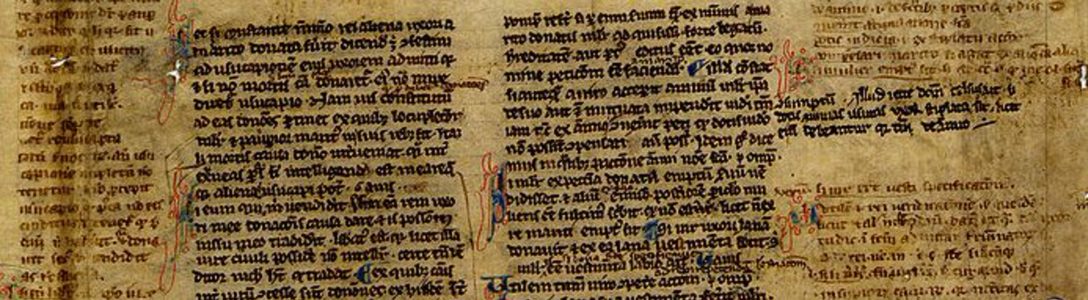

Indeed, in English jurisprudence, ideas regarding the legal protection of free trade and competition emerged around the same time as liberal economics in the 18th century. Traditionally, “monopolies” (or perhaps more accurately, “exclusive licenses”) were granted by the English Crown in the form of patents, or other arrangements. Trade and commerce were strictly controlled, and “fair” business practices were protected by medieval laws against “engrossing, forestalling, and regrating” which largely prohibited the predatory buying up of a certain good (such as grain) and re-selling it for a profit. See Edward A. Adler, Monopolizing at Common Law, 41 Harvard L. Rev. 246, 251 (1917). This practice was “unfair” because it was unjust, because it was dishonest, and because it enriched the seller at the expense of the people. The common good was understood as justice, ultimately tethered to the teachings of the Church, and the law recognized the moral consequences of business decisions.

After the Reformation, and with the rise of Parliamentary supremacy in the seventeenth century, the ability of the Crown to regulate trade through the granting of monopolies was significantly and irrevocably diminished. See William Letwin, English Common Law Concerning Monopolies, 21 Univ. Chicago L. Rev. 355, 359 (1954). The medieval laws against “engrossing, forestalling, and regrating” and other unfair business practices were repealed in the 18th and 19th centuries. The infant United States, of course, was founded on this same rejection of “restraints on trade” and placed the freedom of commerce, or rather the freedom of competition, at its very core.

Therefore, it is no surprise that by 1890, on the eve of the passage of the Sherman Act, the laissez faire American economy had allowed “titans of industry” to flourish, wielding not only economic power, but also significant political and social power. This troubling influence led to the passage of the Sherman Act. As ex-president (and future Supreme Court Justice) William Howard Taft wrote in 1914, “[t]he federal anti-trust law is one of the most important statutes ever passed in this country. It was a step taken by Congress to meet what the public had found to be a growing and intolerable evil in combinations between many who had capital employed in a branch of trade, industry, or transportation, to obtain control of it, regulate prices, and make unlimited profit.” William Howard Taft, The Anti-Trust Act and the Supreme Court 2 (1914) (emphasis added). However, despite Taft’s strong language, the end goal of the antitrust laws was not to make a moral condemnation of rapacious business conduct in furtherance of the common good, but rather the protection of “individual liberty” by removing limitations on the rights of property and the freedom to contract. Taft 3-4. The “suppression of competition” is what led to “the building of great and powerful corporations which had, many of them, intervened in politics and through use of corrupt machines and bosses threatened us with a plutocracy.” Taft 4.

The framers of the Sherman Act (which would be later accompanied by the Clayton Act in 1914) accurately identified the societal threat of a plutocracy run by sprawling businesses and their omnipotent leaders. However, the ultimate tool which they crafted to combat this threat was crippled from birth by the limited “good” it sought to defend: free competition. Where the only “good” articulated by the law is “restor[ing] competitive conditions” (See Google complaint ❡194.d), of course the courts will be at a loss to determine whether an act constitutes wrongdoing without the “objective” analysis of experts. This reduction of the good to purportedly neutral analysis is a core feature of liberalism. Indeed, even the most radical use of the antitrust laws, the “trust busting” looked upon with such nostalgia by antitrust academia, rarely resulted in upholding the common good as measured by morality and justice. Instead, its aim was the furtherance of the incomplete good of “individual liberty”, as defined solely by the number of competitors in a predefined market, a mix of products or services, and consumption, often resulting in limited benefit to the public.

This can be seen in the outcomes of some of the most important antitrust cases in U.S. history. In the wake of the Supreme Court’s landmark 1911 decision in Standard Oil Co. of New Jersey v. United States, Standard Oil was broken into 33 different companies. As a result, the wealth of John D. Rockefeller, already the nation’s wealthiest man, tripled. United States v. Microsoft Corporation, 253 F.3d 34 (D.C. Cir. 2001), on which the Google complaint largely relies, left the corporation intact, with a settlement mandating certain practices affecting the narrow economic market in which Microsoft was deemed a monopolist. Finally, financial analysts have already praised the “worst case scenario” of a break up of Google as a way of bringing increased value to its shareholders, with Jim Cramer exclaiming “if the Department of Justice is going that route, then they’re just a great investment banker.”

When we express wariness over the role of Big Tech companies, are we really worried about “restor[ing] competitive conditions” in the “markets for general search services, search advertising, and general search text advertising”? Is this the “growing and intolerable evil” that troubles the public? Of course not. We’re worried about the increasingly powerful plutocracy of these titans of industry, who like the Rockefellers before them, seem impervious to regulation rendered toothless by its aim of protecting “the free market.” Big Tech, like the fabled monopolies of the nineteenth century Gilded Age, grew to become hegemonic in the fertile soil of American liberalism. Both Democratic and Republican administrations were blinded into regulatory inaction by the myth of entrepreneurship nurtured by the industry’s extensive lobbying and campaign contributions. Even in the last days before the 2020 presidential election, Big Tech money is bankrolling PACs and political ads, with the billionaire co-founder of Facebook Dustin Moscovitz alone spending $22 million on ads.

Why regulate business conduct at all if the only goal is to preserve the rules of play so that the next Google can rise to domination? This is why antitrust enforcement will always fall short of vindicating actual fairness, as opposed to a “fairness” only defined by offenses to “competitive conditions.” In the absence of a legitimate moral authority that can anchor antitrust regulation to the common good, “trust busting” will continue to enrich lawyers, economists, and corporate shareholders, while doing little to erode the influence of big business plutocrats.

Maria Messina